- Nassau County School District

- Referendum

-

Please view below for information shared prior to the Referendum passing.

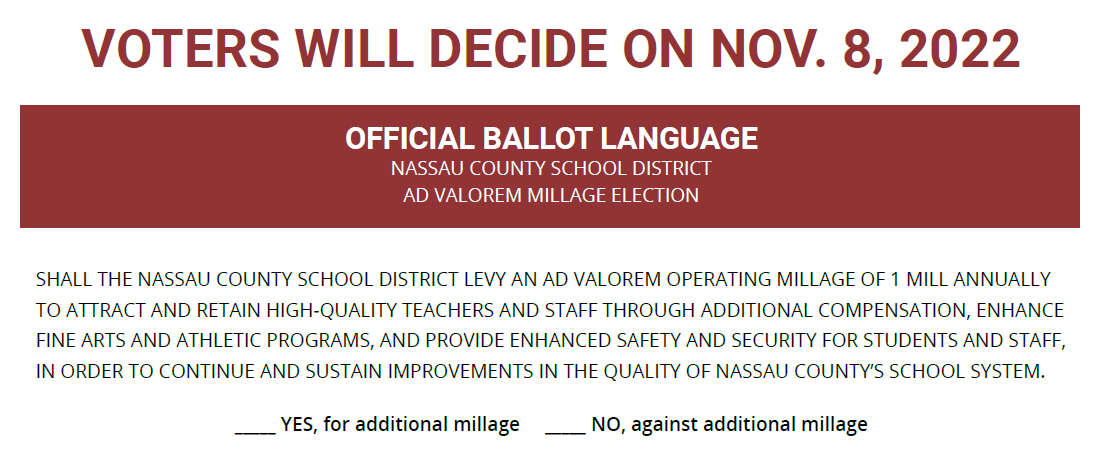

Voters will decide on November 8, 2022, whether to approve a 1 mill increase in property taxes to attract and retain high-quality teachers and staff, and enhance art, athletics, safety, and security for students.

"Teachers need to hear that they are supported by the community."Discussing How Money Is Designated

Key Dates -

September 29 — Ballot ready for pick-up

October 11 — Deadline to register to vote

October 26 - November 5 — Early voting

November 8 — General Election Day

-

Why It's Needed

While the state provided an increase in starting teacher salaries, it resulted in our most experienced teachers making the same or slightly more.

Many of these teachers are going to other districts or moving into higher-paying, less stressful jobs. Nassau County’s average teacher salary ranks 44th out of 67 Florida districts, in a state that ranks 48th out of 50 in the nation. Salaries are cited as one of the main reasons there is a national teacher shortage, which is now impacting Nassau County vacancy rates.

-

Experience Lagging

Nassau County ranks 50th out of 67 Florida districts in average years of experience for our teachers.

It's the experienced teachers who have the biggest impact on our students. They are more than teachers. They are coaches, mentors, activity leaders, and parent liaisons. When experienced teachers leave the profession, it has a profound impact on student learning.

-

Counties Passing It

-

Millage referendums have been successfully voted on in 20 Florida counties, and several more are on the ballot this year.

-

-

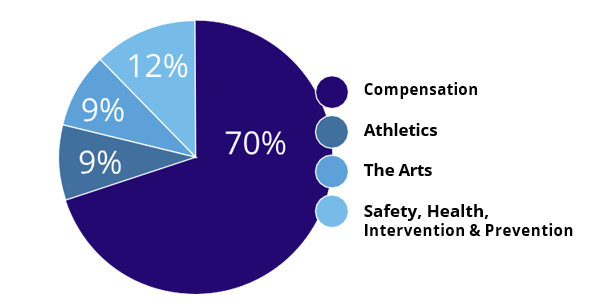

How Will It Be Spent?

-

Most of the $13.7 million raised each year will go toward teacher compensation. People who support the schools, such as security, counseling, and maintenance personnel, will also receive a boost in pay. Additional funding will go to improve the arts and athletic facilities, along with some safety and security upgrades.

-

-

Why Isn't There Enough Money?

-

School budgets are complicated, but basically, they are divided into restricted categories, which reduces the amount available for teacher salaries.

For example:

- Capital dollars are only available for the renovation, repair, and construction of schools, along with land acquisition. These funds cannot be transferred to salaries.

- The lottery provides less than 1% of the budget and the state dictates that it goes to Bright Futures scholars and higher education.

- There is no category of funding for enhancements to the arts and athletics, which is why it’s included in the 1 mill spending.

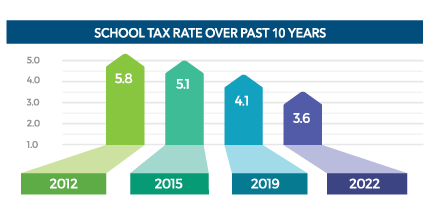

In addition, the state has mandated a steady decline in the Required Local Millage rate each year from 5.8 in 2012 to 3.6 mills today. This was done to offset increases in property values, but it reduced the district’s ability to keep up with growth and inflation. If the 1 mill passes, it’s still well below the 2012 rate. This is the primary source of funding for school operations, including salaries.

-

-

How Much Will It Cost?

-

One mill equals $1 for every $1,000 of assessed value, minus the $25,000 homestead exemption. For example, a home with a value of $300,000 will pay $275 a year, or about $23 a month.

-

How Will We Know How It's Spent?

- A Citizen's Oversight Committee will review expenditures and report to the public. The district budget is on the website and subject to multiple audits each year. All of the funds collected in Nassau County stays here.

Click here to read the Frequently Asked Questions.

Click here to view educators sharing their experiences.

-

-